The Strategic Growth Annuity Series provides a combination of guarantees, flexible interest crediting choices and withdrawal options. The series includes:

- The Strategic Growth Annuity: Features highly competitive caps/participation rates/spreads and enhancements

- The Strategic Growth Plus Annuity: 13% Bonus with competitive caps/participation rates/spreads and enhancements

- The Strategic Growth 7 Annuity: 7-yr surrender charge period product with competitive caps/participation rates/spreads and enhancements, plus issue age up to 85

- Rate Buy Up Feature: Offered on all Strategic Growth products as an optional feature, enhances the Cap, Participation Rate and Spreads for a Buy Up Charge.

Below is our collection of product information and marketing resources to help you build your business.

Product Literature

Below are downloadable resources that help explain the features and benefits of each product through brochures, fact sheets and rate sheets. Respective Statements of Understanding are also provided here.

Product features vary by state, including, but not limited to the Surrender Charge rates, Surrender Charge period, Bonus, Bonus Recapture and applicability of the Market Value Adjustment.

Download Strategic Growth Series State Variations (PDF)

| Product | Brochure | Fact Sheet | Rate Sheet | Statement of Understanding |

| Strategic Growth | ||||

| Strategic Growth Plus | ||||

| Strategic Growth 7 |

Crediting Diversification Strategies

Use these consumer-approved pieces to provide a quick overview of how each crediting option would have performed over the years. We offer charts that represent each product with and without the Buy Up Feature.

| Product | Without Buy Up Feature | With Buy Up Feature |

| Strategic Growth | ||

| Strategic Growth Plus | ||

| Strategic Growth 7 |

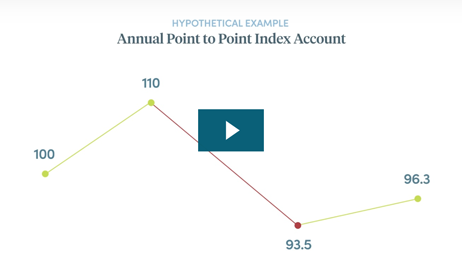

Index Videos and Materials

Below are explainer videos and brochures that highlight the various financial index benchmarks used in calculating interest credits.

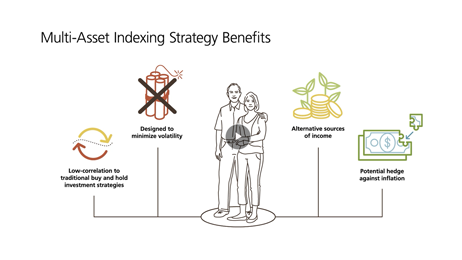

Client-Approved Marketing Materials

Below are downloadable marketing materials to help demonstrate the value of the Strategic Growth Series of Annuities.

| Includes Strategic Growth, Strategic Growth Plus, and Strategic Growth 7 | |

|---|---|

Use this agent reference guide for an overview of all the features of the Strategic Growth Series of Annuities. |

Use this consumer-approved piece to provide a quick overview and brief explanation of the various index-crediting options available inside the Strategic Growth Series of Annuities. |

Learn how the Rate Buy Up Feature can enhance the caps, spreads, and participation rates your client receives. |

This chart depicts how the stock market performance and its volatility have affected a typical 60 year old investor over the past 30 years. |

Learn more about Security Benefit, including our Financial Strength. |

Learn more about Security Benefit. |

An educational piece for clients that describes the general concept of a Fixed Index Annuity. |

|

| Includes Strategic Growth |

|---|

Use this consumer-approved hypothetical example to demonstrate how Strategic Growth Annuity can be an alternative to traditional fixed income allocation. |

| Includes Strategic Growth Plus |

|---|

Use this customizable, client-friendly ad to help promote our 13% Bonus on Strategic Growth Plus |

Client Registration

Visit SecurityBenefit.com for instructions on how to register your clients for account access.